Saving Money Without Feeling Restricted

Saving money without feeling restricted can sometimes sound like a bad idea. When people hear the word “saving,” they often think about giving up fun things, feeling bored, and saying no to things they enjoy. It can feel like a long time before you can buy things, and every little treat feels wrong or makes you feel guilty.

So people try to save, and then quietly stop. Not because they don’t care about their future, but because the process feels like punishment.

Here’s the truth that changes everything:

Saving only fails when it feels restrictive. When saving feels supportive, it sticks.

This article is about building savings in a way that works with human behaviour, not against it. No extreme frugality. No joyless living. Just innovative systems that quietly build security while you continue to enjoy your life.

Why Most Savings Advice Fails

A lot of popular money-saving advice is built on good ideas, but it doesn’t always match how people really live or their unique situations.

You’ve heard it before:

“Just spend less.”

“Cut out coffee.”

“Live below your means.”

“Have more discipline.”

On paper, it all makes sense.

In real life, it rarely works.

People often struggle to save money, not because they don’t understand the math, but because the advice given doesn’t account for how we really behave.

Many think that we can rely on willpower every day, but that’s not true. When we give in to small treats, it shouldn’t mean we are weak; it’s normal to enjoy life a little. Also, factors like stress, fatigue, and negative experiences can affect how we act.

The advice also expects us to be consistent, even when life is unpredictable. So, people don’t stop saving because they are irresponsible; they stop because the way saving is presented feels punishing. Instead, saving money should be seen as something positive, not just a difficult task to get through.

It should feel like something that’s helping you live better, not less.

The “Easy Wins First” Method

Momentum doesn’t come from suffering. It comes from things feeling doable.

The fastest way to begin saving is by making small, manageable changes that fit into your daily routine and feel easy to do.

The “easy wins first” approach looks for savings that:

- take almost no effort,

- don’t disrupt how you live,

- and show results quickly.

The early wins matter because they build confidence. Seeing proof that small changes work makes you feel capable and motivated to continue.

Real progress comes when it’s easy and manageable, not when it’s stressful, helping you feel less overwhelmed and more confident in your ability to improve your finances.

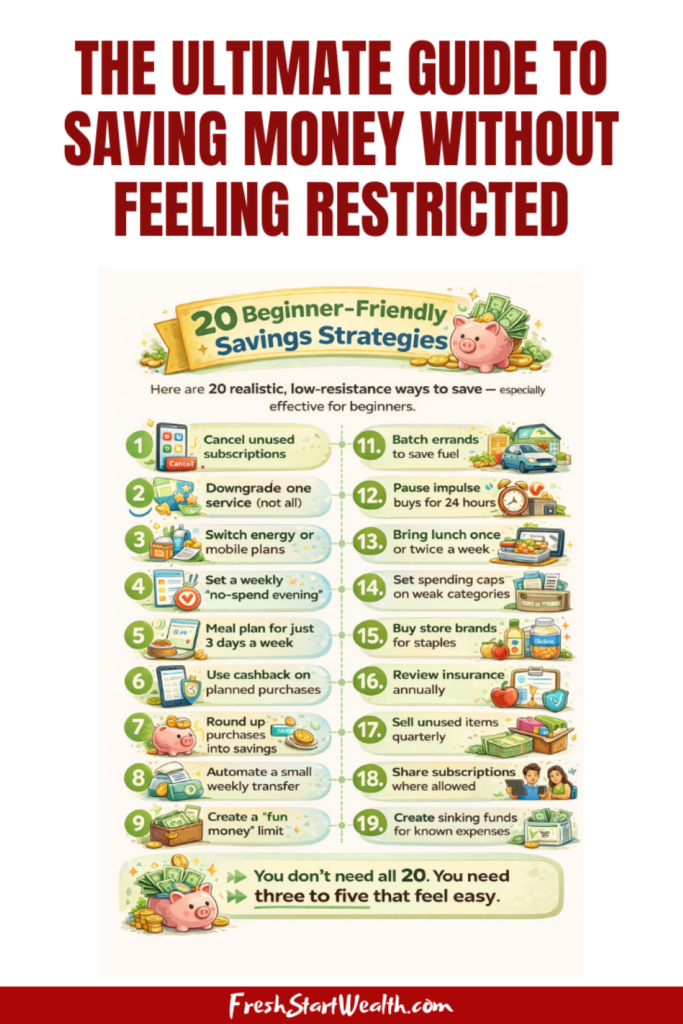

20 Beginner-Friendly Savings Strategies

Here are 20 realistic, low-resistance ways to save — especially effective for beginners.

- Cancel unused subscriptions

- Downgrade one service (not all)

- Switch energy or mobile plans

- Set a weekly “no-spend evening”

- Meal plan for just 3 days a week

- Use cashback on planned purchases

- Round up purchases into savings

- Automate a small weekly transfer

- Create a “fun money” limit

- Use price alerts for big purchases

- Batch errands to save fuel

- Pause impulse buys for 24 hours

- Bring lunch once or twice a week

- Set spending caps on weak categories

- Buy store brands for staples

- Review insurance annually

- Sell unused items quarterly

- Share subscriptions where allowed

- Create sinking funds for known expenses

- Redirect windfalls before spending

You don’t need all 20. You need three to five that feel easy.

How to Create a Monthly Savings Plan (That Actually Works)

A savings plan should feel boring — and that’s a good thing.

Here’s a simple structure:

Step 1: Set Up Your Savings Plan

Think about the main reasons you want to save money. These could be:

– An emergency fund for unexpected events

– A buffer fund for surprise expenses

– Sinking funds for specific future needs

– Short-term goals (like vacations or big purchases)

You don’t have to work on all your goals at the same time.

Step 2: Choose a Savings Amount That Feels Comfortable

Begin with an amount of money that feels comfortable for you. For example, saving £25 every week can be easier and more helpful than saving £100 only once in a while. It’s better to save a small amount regularly than to save a significant amount only sometimes. Consistency is more important than how much you save at once. A small amount you can stick with will take you further than considerable efforts that feel hard to repeat.

Step 3: Set Up Automatic Savings

Set it up so your bank automatically deposits money into your savings account when you get paid. This helps you save money first, rather than waiting until the end of the month.

Step 4: Keep Savings in a Separate Account

Use a different bank account for saving money and for your daily spending. By doing this, you will be less likely to use your savings for things you don’t really need.

Step 5: Check In With Your Savings Each Month

Once a month, take a few minutes to see how your savings plan is actually holding up. Life changes, expenses shift, and your plan should be able to change with you.

This isn’t about judging yourself or doing it “perfectly.” It’s about staying flexible. When your plan adapts to your real life, it’s far more likely to keep working — and to help you reach your goals without burning you out.

The Psychology of Saving (This Is Where Most People Get Stuck)

Saving falls apart the moment it feels like you’re losing something. When that happens, your brain pushes back — hard.

The shift happens when you stop seeing saving as a restriction and start seeing it as support. Saving can serve as a form of protection when something unexpected happens. Relief at the end of the month. A sense of self-respect for taking care of yourself. More freedom in the choices you make. A future that feels easier, not heavier.

When saving is tied to emotional safety, it stops being a chore and starts becoming automatic.

Think about what it means to have good money health: it means staying calm when times are hard, having some savings when you don’t have much money, feeling less worried, and making careful choices instead of acting quickly.

Saving money without feeling restricted is not just about saying no to buying things now; it’s about making a safety net that helps you recover and be prepared for future difficulties.

Habit Stacking for Saving

Habit stacking is all about piggybacking a new habit onto something you already do, making saving feel achievable and straightforward, which can boost your confidence in managing money.

For example, you might:

- Move a bit of money into savings right after you get paid,

- Automatically transfer cash whenever you check your bank balance,

- Review your savings while doing your weekly planning,

- Or shift leftover money the day before payday.

The trick is, you’re not forcing yourself to build an entirely new habit. You’re just tacking it onto one that’s already part of your routine, which makes saving feel less daunting and more manageable.

This straightforward method can help your savings run on autopilot, reducing the need for constant effort and willpower over time.

Savings Challenges: 10 Fun Ways to Boost Your Savings

Saving money doesn’t have to feel like a chore — it can be simple, even a little fun. Here are ten easy ways to help your savings grow without feeling deprived:

- £1-a-Day Challenge: Put aside just £1 each day. By the end of the year, that adds up to £365. It’s a tiny habit that reminds you to save consistently.

- No-Spend Weekends: Choose weekends when you buy only what you really need, helping you see what is important and giving you a break from wasting money.

- £5 Note Challenge: Whenever you get a £5 note, tuck it away rather than spend it. Those small notes can quietly grow into a nice stash over time.

- Round-Up Challenge: When you buy something, round the total amount up to the next whole pound. Save the extra money! Saving little by little makes it effortless.

- One-Category Freeze: Stop spending money in one area for a while, like going out to eat or enjoying entertainment, to help you see how much you normally spend and find ways to spend less without feeling like you are missing out.

- 30-Day Subscription Pause: Try pausing one or two subscriptions for a month. You may find out that you don’t really need all the things you are paying for. This way, you can also save some money.

- Pantry-First Week: Use the food you already have in your kitchen before buying more. It is smart, helps reduce waste and can be very enjoyable.

- Cashback-Only Savings. For one month, take any money you get back from shopping or rewards and put it directly into your savings. This way, your usual spending can help you save a little extra money for the future.

- Side-Income Savings Sprint: Take on a small side gig or extra work and save all the additional income. This is a fun way to supercharge your savings without touching your regular budget.

- Month-End Sweep Challenge: At the end of every month, take any extra money from your budget and put it into savings. This helps you spend money carefully and easily saves you some extra cash.

These challenges aren’t about cutting all the fun out of life — they’re about making saving simple, noticeable, and even a little rewarding, helping you feel more in control of your money.

How to Stop Living Paycheck-to-Paycheck (A Beginner Action Plan)

The “Automatic Savings” Strategy (Your Secret Weapon)

Using automation is a simple way to saving money without feeling restricted in an effortlessly manner that helps beginners feel capable and encouraged to start saving.

Why It’s Helpful:

– No More Confusion: When you set up automatic savings, you don’t have to think about it all the time. You make one decision, and it’s done.

– No More Waiting: Automatic transfers help you stick to your savings goals without putting it off.

– Helps You Save Easily: This method makes it simple to save money every month without having to plan it.

– Reduces Unwanted Shopping: When you set up automatic savings, you spend less on things that you don’t really need.

Steps to Start a Savings Plan:

- Decide how much money you want to save from each paycheck.

- Make automatic transfers to your savings account on the same day you get paid, which helps you manage your money better.

- Use a special savings account that gives you a higher interest rate to keep your saved money separate and earn more over time.

Even saving a small amount like £10 to £25 each month can add up to a lot over time. Highlight the benefit of saving small amounts to motivate readers by showing how it adds up over time: this system helps your savings grow on its own, so you don’t have to keep pushing yourself to do it, making it easier to stay consistent.

How to Increase Savings Over Time (Without Stress)

As your life and finances change, your savings can grow too, without feeling like a struggle.

- Increase Savings Gradually: Rather than trying to save a big chunk all at once, make small adjustments over time. Even a tiny increase as your income grows can add up without affecting your day-to-day life.

- Put Raises to Work: When you get a raise, consider saving some or all of it. You can boost your savings without cutting back on anything you already enjoy.

- Save Bonuses Right Away: Instead of spending unexpected bonuses or extra payments, move them straight into savings. That way, you’re building a financial cushion without missing what you usually rely on.

- Revisit Old Saving Tricks: Check back on any strategies you’ve used before. Sometimes the simplest methods — even ones you’ve forgotten — are the easiest ways to give your savings a quiet boost.

Savings should grow with your life — not compete with it.

Common Savings Mistakes to Avoid

- Setting Very High Savings Goals: Starting a savings plan with goals that are too high can make you feel overwhelmed and may cause you to give up. Instead, set smaller, realistic goals that you can reach step by step. This way, you will feel good about your progress.

- Seeing Saving as a Chore: If you think of saving money only as giving up things you want, it can feel heavy and stressful. Consider saving as an investment in your future and a way to achieve your goals. This change in thinking can help you stay motivated.

- Keeping Savings Too Easy to Access: If your savings are in an account where you can easily take them out, you might spend them on things you don’t really need. To avoid this, consider opening a savings account with withdrawal limits. This makes it harder to use your savings for unplanned expenses.

- Giving Up After a Setback: It is common to face difficulties while saving. If you have a problem, like spending too much money, don’t feel sad about it. Take a little time to look at your goals and find your way again. Remember, it’s essential to be strong and keep trying.

- Copying Other People’s Saving Methods: Everyone has a different money situation. Don’t try to follow someone else’s way of saving money without thinking about what you need and want. Find a savings method that is best for you.

- Understanding That Progress Isn’t Always Steady: Your savings progress may go up and down due to different factors in life. Recognise that this is normal, and keep your motivation during tough times.

- Focusing on Regular Savings Instead of Big Amounts: Regularly saving smaller amounts of money can be more effective than saving large amounts only sometimes. Making consistent, smaller contributions can grow your savings over time.

By identifying these typical errors, you can enhance your savings strategy and achieve your financial objectives more effectively.

Related articles:

How to Start a Budget from Scratch: The Complete Beginner’s Guide

How to Stop Living Paycheck-to-Paycheck (A Beginner Action Plan)

An Awesome Guide To Rebuild Fantastic Financial Life For Beginners

Top 10 Budgeting Mistakes And How To Fix Them

How to Start Investing for Beginners (Starting With Just £10)

Conclusion — Saving Money Without Feeling Restricted

Saving money isn’t just about cutting back — it’s about finding a way that works with your life and feels manageable. Saving Money Without Feeling Restricted is the best approach to makes you feel calm, reduces stress, and builds confidence without making you feel like a chore.

When your savings support your choices rather than limit them, it’s easier to create habits that stick. Small, steady strategies that feel easy to follow can add up to big money savings over time. When these habits become a part of our everyday lives, they not only help us feel more secure with our finances but also make us feel better overall. This leads to greater happiness, a sense of power over our lives, and more satisfaction in our daily activities.

How to Start Investing for Beginners (Starting With Just £10)

Leave a Reply